Appraisal Modernization

A SingleSource for your Appraisal Modernization and Data Collection Needs

What is appraisal modernization?

Appraisal modernization is the process of utilizing a variety of valuation products in order to better match the valuation to the risk of the loan transaction and make the entire process more efficient for all parties. The GSEs have been accumulating large amounts of appraisal data over the years to create their databases which are the basis for the appraisal modernization initiative. Appraisal is changing through this process, but it’s not going away. It’s only evolving to different levels of analysis.

Who Benefits?

There are many reasons why the appraisal modernization program has been created and there are many benefits to all parties in the mortgage space. Lenders experience shortened loan origination cycle times, consumers save money and time in their loan application, and service providers like SingleSource can utilize a larger network of data collectors to reduce any potential appraiser capacity issues.

How can you get started?

Our advice to lenders: find a compliant full-service provider that can offer you the latest technology and a range of product offerings.

As a licensed AMC, SingleSource offers a range of valuation and data collection products to support the appraisal modernization program. Our suite of solutions is backed by our proprietary mobile application, SingleVue™.

We have designed SingleVue™ to assist data collectors with a simple, user-friendly interface to quickly gather details and a digital layout of a property. The mobile technology also allows for additional features through our third-party mobile data collection partnerships including digital scans for producing floor plans. These options give our clients the best technology available in the market today, all in one place. We like to stay true to our name, and our reputation as the SingleSource for the industry.

Why singlesource?

Extensive Experience and Trusted Service Provider

SingleSource has been providing valuations nationwide since 2000, in addition to providing field services and inspection services nationwide since 2006. Over the years we have built an experienced nationwide panel of vendor partners to support our service offerings.

Direct Integration with Fannie Mae

SingleSource is proud to be one of the service providers supporting Fannie Mae's Value Acceptance + PDR program.

Proprietary Mobile App

We have designed our own proprietary app, SingleVue™, that offers a combination of all the latest technology in one place to make your life easier.

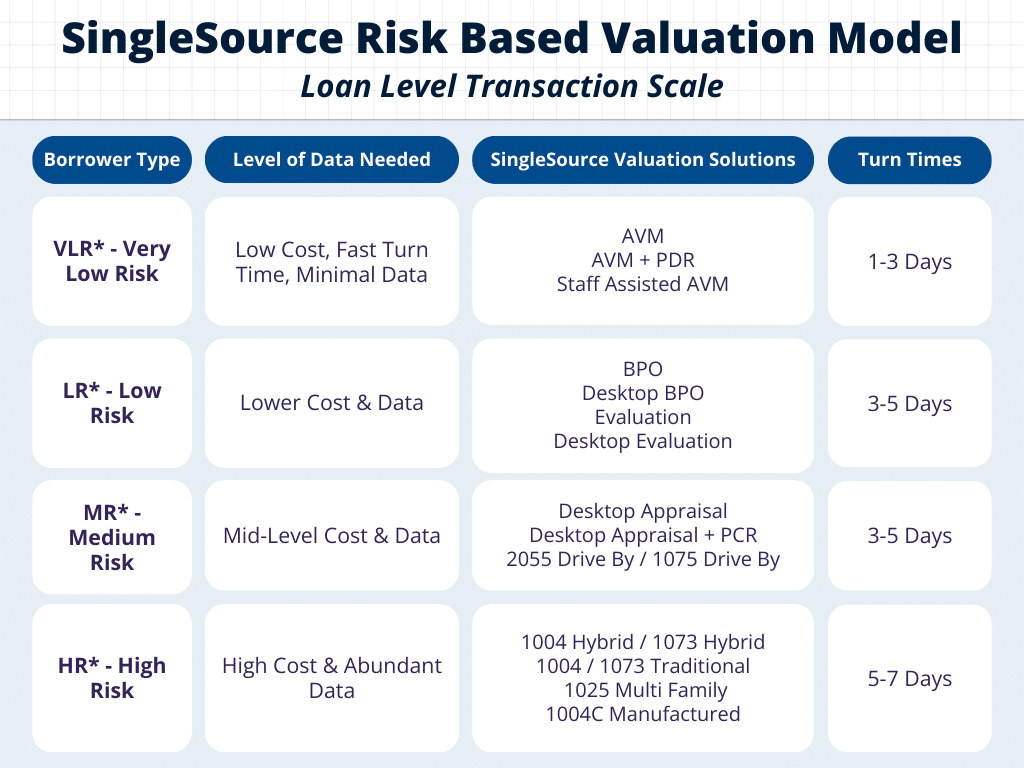

The SingleSource risk based valuation model

Not only do we provide valuation services, but we also often help our customers develop collateral risk management programs to help them make the best risk-based decisions.

Many times our clients aren’t sure what valuation product to order. We recommend always assessing the risk of the transaction before selecting an appropriate option to determine a property’s value. Rather than relying on a full appraisal for every property, we suggest our customers manage their collateral risk by looking at several factors including total loan to value, borrower credit score, borrower reserves, property type, and, for fix and flip loan products, size of the repair budgets.

Check out our Risk-Based Valuation Model to help you choose the right valuation depending on the loan level risk:

*Type of Borrower Definitions:

- *Very Low Risk (VLR) – Excellent credit, assets, equity, high cash reserves, steady income

- *Low Risk (LR) – Good credit, some equity, low cash reserves, steady income

- *Medium Risk (MR) – Mid-level credit, some equity, no assets, low reserves, self-employed or new job

- *High Risk (HR) – Low credit score, low equity, no assets, no reserves, several jobs

The SingleSource Appraisal Modernization and Data Collection Suite:

- Fannie Mae Value Acceptance + Property Data |

- Freddie Mac ACE+PDR |

- 1004 Hybrid / 70H |

- 1004 Desktop / 70D |

- SingleSource Desktop Appraisal |

- AVM + Property Data Plus |

- Full suite of AVM products |

- Full suite of Interior / Exterior or Exterior only Property Data Reports

Learn more about the SingleSource Valuation solutions and SingleSource Inspection solutions.